From a venture investor’s diary #1: The power of thinking long-term, practicing a “craft”

- By ssyc1

- August 31, 2021

- No Comments

Saw two companies that are not yet ready for their first institutional funding round. Reminder to myself: need to be a long-term minded investor. Translation: there are always opportunities to … Continue Reading

The art and science of venture investing – #3: it’s investing vs divesting and the “relationship”

- By ssyc1

- March 6, 2020

- No Comments

Some of the most interesting analyses about investing that has been making the rounds of the institutional investment community in the last few years has been about how fund managers … Continue Reading

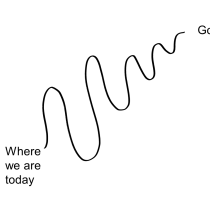

The Power of the Power Law, “super-stars”, and moving the returns curve “to the right”!

- By ssyc1

- February 21, 2019

- No Comments

I finally get to jot down some of my thoughts here about the “power law”, and more specifically the “power of the power law” …. I. The phenomenon of superstars OK, … Continue Reading

The art and science of venture investing – #2: the search for great companies and great opportunities

- By ssyc1

- August 31, 2017

- No Comments

Why is it so hard to find great opportunities? Why are big success stories and sustained growth still so rare? What is the “formula” for improving our chance of backing … Continue Reading

The art and science of venture investing – #1: dealing with “hotness” and “coldness”, luck vs skill, intellectual honesty, and others

- By ssyc1

- August 29, 2017

- No Comments

I’m recently back from a large tech conference where some participants were discussing the question whether AR, VR and AI is “too hot”? Should I pay any attention to what … Continue Reading