From a venture investor’s diary #4: 7 scale-up dos and one don’t-do

- By ssyc1

- April 19, 2023

- No Comments

To help young companies increase their odds of success, I continue to add to my typology of “scale-ups” mistakes to avoid: too early, wrong direction, lack of focus, and so … Continue Reading

The art and science of venture investing – #3: it’s investing vs divesting and the “relationship”

- By ssyc1

- March 6, 2020

- No Comments

Some of the most interesting analyses about investing that has been making the rounds of the institutional investment community in the last few years has been about how fund managers … Continue Reading

Re-imagine: products, policies, digital transformation, machines vs humans

- By ssyc1

- February 27, 2020

- No Comments

As we move into a new decade, it is worth asking broader questions like “what does our world need”? We’ve just sent out an investor newsletter discussing how the world … Continue Reading

Dear Founder #4: not all revenues are created equal

- By ssyc1

- June 5, 2019

- No Comments

[A note from 5 Oct 2019: “gross margins” and “sustainable revenues” has become talk of tech town this past week, and a big-name Silicon Valley VC has made a similar … Continue Reading

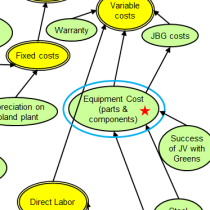

Nuts and bolts #3: your financial model and your understanding of your business, your market and your customers, and your value drivers

- By ssyc1

- February 11, 2019

- No Comments

Dear founder. This is a letter to all you founders who are preparing a financial model for your Series A or even Series B round. First, may I congratulate for … Continue Reading

The art and science of venture investing – #2: the search for great companies and great opportunities

- By ssyc1

- August 31, 2017

- No Comments

Why is it so hard to find great opportunities? Why are big success stories and sustained growth still so rare? What is the “formula” for improving our chance of backing … Continue Reading

The art and science of venture investing – #1: dealing with “hotness” and “coldness”, luck vs skill, intellectual honesty, and others

- By ssyc1

- August 29, 2017

- No Comments

I’m recently back from a large tech conference where some participants were discussing the question whether AR, VR and AI is “too hot”? Should I pay any attention to what … Continue Reading

Nuts and bolts #1 – 8 things about Term Sheets

- By ssyc1

- March 17, 2017

- No Comments

Yes – fundraising and Term Sheets. Something many founders have to deal with. We often get asked about this. And we find ourselves saying to founders more often than not … Continue Reading

What an investment decision mean to us

- By ssyc1

- December 16, 2016

- No Comments

As venture capitalists, we are in the business of seeing and reviewing hundreds and thousands of business plans of young tech companies looking for their first or second round of … Continue Reading